Shaken, Not Stirred: The Dynamic Shift from Commercial to Craft in the Spirits and Wine Market

Exploring the Rise of Craft and Premium Spirits Amidst the Decline of Traditional Beverages and the Surge of Non-Alcoholic Alternatives

The numbers tell an intriguing story: while commercial spirits struggle with an 8% volume drop, premium spirits are growing at 12.2% annually. But beneath these statistics lies a more complex narrative about changing consumer preferences, market dynamics, and the future of the beverage industry.

The conventional wisdom suggests a simple story: younger consumers want craft, premium products are thriving, and commercial brands are dying. But the reality is far more nuanced – and more interesting.

Beyond the Premium vs. Commercial Narrative

Let's start with a surprising truth: the shift from commercial to premium isn't just about quality or price point. While premium spirits are indeed growing faster (9.2% CAGR projected through 2028), what's really happening is a fundamental reimagining of how consumers engage with spirits.

Consider this: 54% of 18-34-year-olds choose premium drinks, compared to just 35% of those over 55. But here's what's fascinating – these younger consumers aren't just buying expensive bottles. They're part of a broader shift in consumption patterns that includes both premium spirits and non-alcoholic alternatives.

Historical Context and Market Dynamics

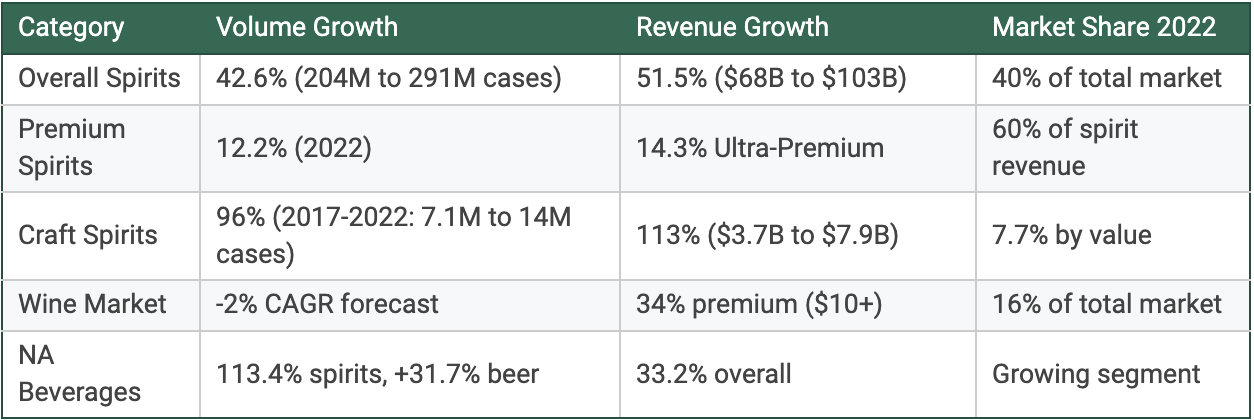

Let's start with some numbers that might surprise you. Over the past decade, the spirits industry's volume grew at a modest 2.6% CAGR, while revenues climbed at 3.7%. This seemingly small gap tells a powerful story about value creation. But here's where it gets interesting: during this same period, craft spirits exploded from 7.1 million cases to 14 million cases (2017-2022), nearly doubling their market presence.

Our analysis of market evolution reveals three distinct patterns:

Market Evolution Analysis

Key Takeaways:

Premium growth outpaces volume growth significantly, indicating value creation through premiumization

Craft spirits show explosive growth but still represent a small market share, suggesting room for expansion

Regional and demographic variations reveal targeted growth opportunities, particularly in Asia-Pacific (45% of global premium market)

But here's what most analysis misses: while commercial spirits saw an 8% volume decline last year, they still command significant market share. The real story isn't about decline – it's about transformation.

The Questions Nobody's Asking

Industry discussions typically focus on growth rates and market share, but several critical questions remain unexplored:

Is the premium segment sustainable, or are we witnessing a bubble?

How will the surge in non-alcoholic alternatives (growing at 7.8% annually) affect different market segments?

Can commercial brands innovate their way out of decline?

These questions matter because they challenge fundamental assumptions about where our industry is headed.

The Hidden Story in Consumer Behavior

The data reveals some surprising patterns. While premium spirits are growing, 64% of non-alcoholic beverage growth comes from consumers adding these options to their repertoire rather than replacing traditional spirits. This suggests we're not seeing a simple shift from commercial to premium, but rather a fragmentation of occasions and preferences.

What's more, the traditional assumption that premium equals quality is being challenged. Our analysis shows that many consumers are choosing premium brands not just for taste, but for what they represent – authenticity, sustainability, and storytelling.

The Rise of Premium and Craft

The premium segment's growth isn't just impressive; it's structurally changing the industry. Premium-and-above spirits grew 12.2% in 2022, with ultra-premium surging 14.3%. More tellingly, craft spirits are projected to grow at a staggering 25.3% CAGR through 2030.

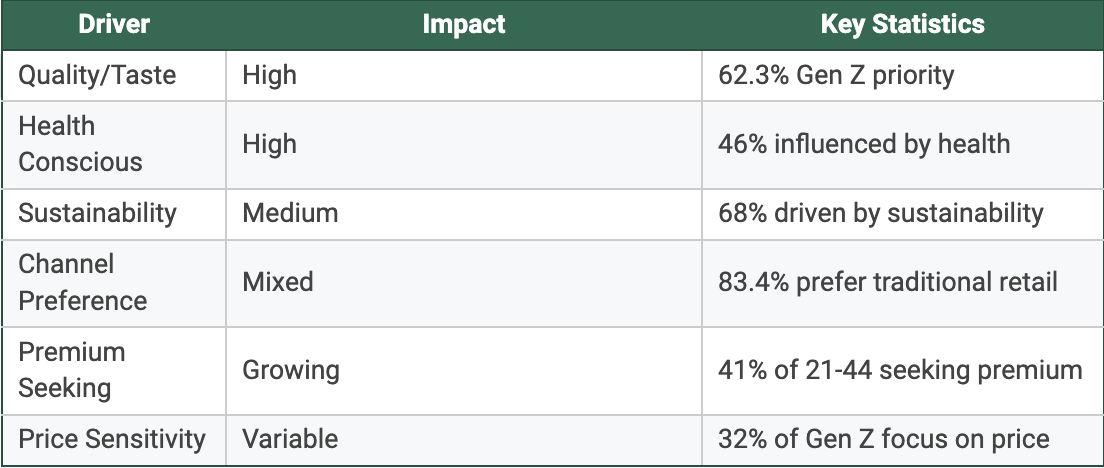

What's driving this? Our consumer behavior analysis provides some insights:

Consumer Behavior Analysis Model

Key Takeaways:

Quality and health consciousness are primary drivers, not just premium positioning

Traditional retail remains dominant despite digital growth, suggesting hybrid strategy importance

Transparency and sustainability increasingly influence purchasing decisions

Impact of Non-Alcoholic Beverages

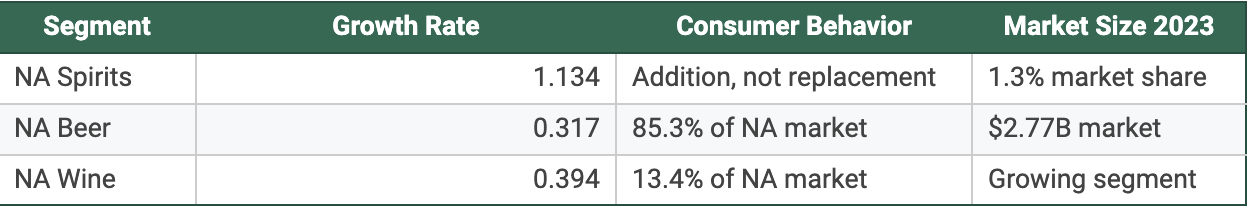

Perhaps the most misunderstood aspect of market evolution is the role of non-alcoholic beverages (NA). The conventional wisdom suggests they're stealing share from traditional spirits.

The data tells a different story:

Non-Alcoholic Impact Analysis Model

Key Takeaways:

NA growth primarily represents category expansion rather than substitution

Younger consumers show different adoption patterns than older demographics

Regional variations suggest targeted opportunity for both NA and traditional products

Here's the key insight: 64% of non-alcoholic beverage growth represents category expansion, not substitution. Even more telling, 82% of NA buyers also purchase traditional spirits. This isn't cannibalization – it's complementary consumption.

Consumer Trends Fueling Premium and Craft Growth

The demographic data reveals some fascinating patterns. While 54% of 18-34-year-olds choose premium spirits (compared to 35% of those over 55), the drivers go beyond simple age segmentation.

Three key trends emerge from our analysis:

Quality Over Quantity

41% of U.S. drinkers aged 21-44 plan to seek more premium spirits in 2024

33% spent $50+ on a bottle in 2022, up from 24% in 2021

62.3% of Gen Z prioritize taste over other factors

Health and Sustainability

46% of consumers consider health impact when purchasing

68% choose products based on sustainability credentials

94% value brand transparency

Channel Evolution

83.4% of Gen Z still prefer traditional retail

Only 12.4% use online delivery services

50% will pay more to support local businesses

Looking Ahead: Trends and Risks

Looking ahead, several key trends are likely to shape the market:

Continued Premiumization

Premium wine segments ($40+ for Champagne, $10+ for other sparkling) show strongest growth potential

Ultra-premium spirits expected to maintain double-digit growth

Craft spirits projected to reach 10% market share by value by 2025

Channel Innovation

Direct-to-consumer expected to grow despite current challenges

Traditional retail remaining dominant but evolving

Digital discovery driving physical purchases

Regional Expansion

Asia-Pacific maintaining 45% of global premium market share

Emerging markets driving new growth

Regional variations in NA adoption creating targeted opportunities

A Contrary View

While the premium trend seems unstoppable, there's a compelling counter-argument to consider. The focus on premiumization might be creating vulnerability in the market. Economic pressures could force a reassessment of value, and the emphasis on premium positioning might be masking opportunities in the commercial segment.

Moreover, the surge in non-alcoholic alternatives (growing at 33.2% compared to low-alcohol at 8.1%) suggests that consumer preferences are more complex than simply trading up to premium options.

What This Means for You

Whether you're a producer, distributor, or retailer, this shift demands a strategic response. The key isn't choosing between premium and commercial, but understanding how to position your business in an increasingly complex market.

What's your experience with these market changes? Are you seeing similar patterns in your segment of the industry? Share your thoughts and insights below – your perspective helps us all better understand these evolving dynamics.

Let's continue this conversation and shape the future of our industry together.