Tariffs are Here - Now What? Why Premium Spirits Brands Win in Trade Wars

An analysis of market data reveals a counterintuitive truth: while value brands face existential threats, premium and ultra-premium segments often experience positive revenue growth despite barriers.

In discussions about the recent 25% tariffs on Mexican and Canadian spirits, one narrative dominates: catastrophe looms for an industry already struggling with inflation and shifting consumer preferences. Headlines warn of devastation, job losses, and market collapse. But what if the conventional wisdom about tariffs is fundamentally flawed—particularly for artisanal and premium producers?

Our analysis of market data reveals a counterintuitive truth: while value brands face existential threats, premium and ultra-premium segments often experience positive revenue growth despite trade barriers. This "tariff paradox" challenges everything we thought we knew about how trade policies reshape markets.

For organizations navigating this complex landscape, understanding the hidden dynamics of tariffs isn't just academic—it's the difference between merely surviving and strategically thriving. Let's explore why the future belongs not to those who lament tariffs, but to those who strategically position to capitalize on the transformation they trigger.

Beyond the Headlines: The Segmented Impact of Tariffs

The narrative that a 25% tariff automatically means a 25% price increase ignores market realities. Our analysis reveals dramatically different price impacts across segments: from 30% increases in value tiers to just 19% in ultra-premium categories.

More striking are the demand responses. Value tier tequilas face catastrophic demand drops of 35%, resulting in a net revenue decline of 18.75%. Meanwhile, ultra-premium brands see only a 12% volume decrease but experience a surprising 4.75% increase in net revenue.

This pattern emerges across categories and isn't simply anecdotal. During previous tariffs on European products in 2019, premium Scotch whisky and Champagne brands maintained profitability while value imports collapsed. The data consistently shows price elasticity favors premium positioning—the very reason ultra-premium tequila brands could raise prices during the pandemic without sacrificing market share.

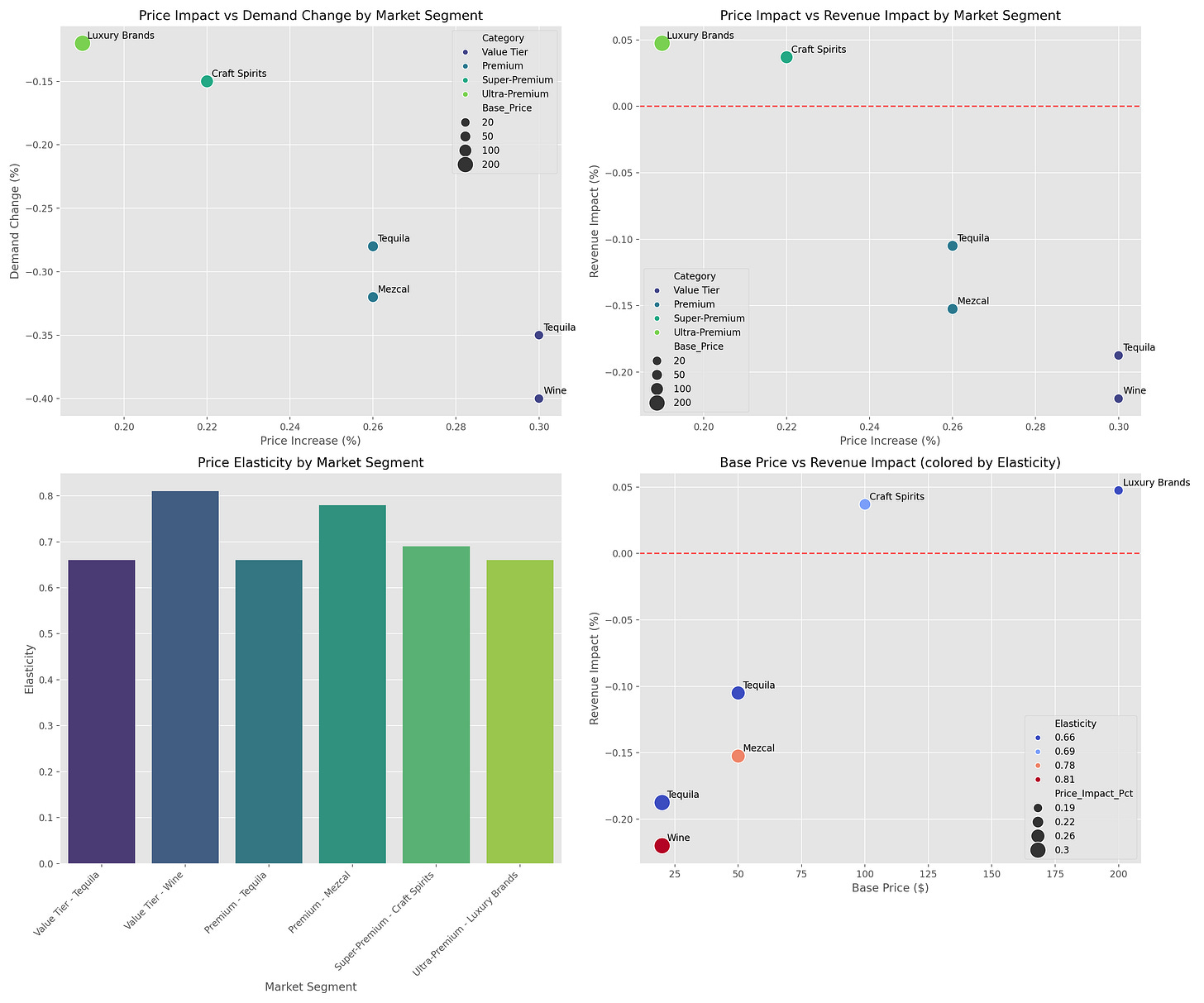

Market Segment Elasticity & Revenue Impact Model

Analysis of 25% tariffs on Mexican and Canadian spirits reveals distinct elasticity patterns across market segments, creating opportunities for strategic positioning:

Key Insights:

While a 25% tariff suggests a uniform impact, actual price increases range from 19-30% due to varying cost structures and pricing strategies across segments

Value tier products suffer catastrophic demand drops (-35% to -40%) and significant revenue decline

Premium segments show moderate resilience with manageable demand drops

Most significantly, super-premium and ultra-premium segments actually show positive revenue impact despite tariffs

The elasticity data reveals the strategic opportunity: premium positioning offers natural tariff protection through brand loyalty and experience-based consumption

This model demonstrates why many premium brands survive or even thrive during tariff periods. Their customers value quality, storytelling, and exclusivity over price alone. For artisanal producers, this suggests that doubling down on premium positioning may be more effective than price competition.

Why does this happen? Premium consumers value story, experience, and authenticity over price alone. When a bottle represents identity and connoisseurship rather than mere utility, price sensitivity diminishes. For artisanal producers, this suggests doubling down on premium positioning rather than competing on price—a strategy counterintuitive to traditional tariff responses.

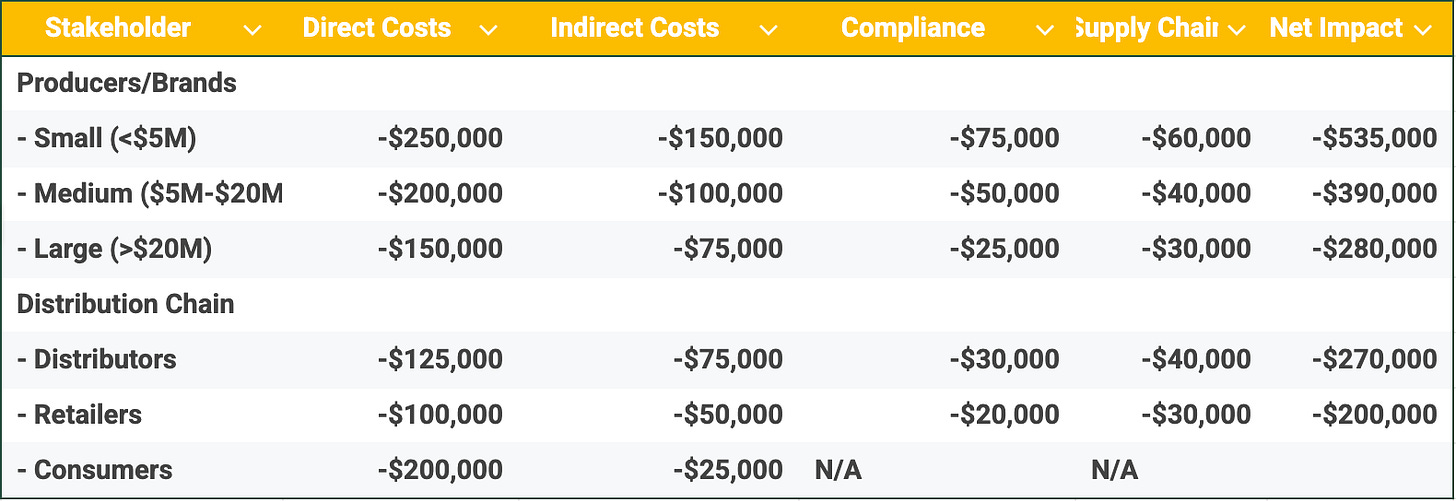

The Scale Disadvantage: How Small Producers Bear the Burden

While premium segments show resilience, smaller producers face disproportionate challenges regardless of category. Our cost-benefit analysis reveals that small producers (<$5M revenue) bear nearly double the relative cost burden (-$535,000 per $1M revenue) compared to large producers (-$280,000).

This disparity manifests across three critical areas:

Compliance costs hit smaller producers (if self-export) three times harder relative to revenue

Supply chain disruption expenses are 2x higher for small producers

Direct tariff costs impact smaller brands more severely due to lower absorption capacity

Stakeholder Impact Per $1M Revenue by Company Size

Our cost-benefit analysis reveals how tariffs disproportionately impact smaller producers, creating structural disadvantages in the market:

Key Insights:

Small producers (<$5M revenue) face nearly double the relative cost burden (-$535,000 per $1M revenue) compared to large producers (-$280,000)

Compliance costs hit smaller producers disproportionately hard (-$75,000 vs -$25,000) due to fixed costs spread across lower revenue

Supply chain disruption costs are 2x higher for small producers relative to revenue

The three-tier distribution system partially insulates consumers, but they still bear significant costs through higher prices

This analysis underscores why tariffs tend to accelerate consolidation—large producers can better absorb the shock through economies of scale, compliance expertise, and supply chain flexibility. Small artisanal producers need specialized support to navigate these headwinds and maintain business continuity.

The question becomes not whether tariffs hurt—they do—but how brands of different sizes can adapt. Large producers like Diageo can leverage scale, absorb costs, or shift production strategies. But what about craft producers, family-owned distilleries, and boutique importers?

Max Murphy of Tozi Imports, a small mezcal and Mexican wine importer, captured this anxiety when he told Reuters: "It's just my wife and I. And if all of our inventory suddenly jumps 25%, there's a good chance it could put us out of business."

Yet the data tells a more nuanced story. While many small producers will indeed struggle, those who strategically reposition can survive and even thrive. The key lies in three strategic pivots: channel transformation, supply chain restructuring, and regulatory arbitrage—all areas where digital platforms offer significant advantages.

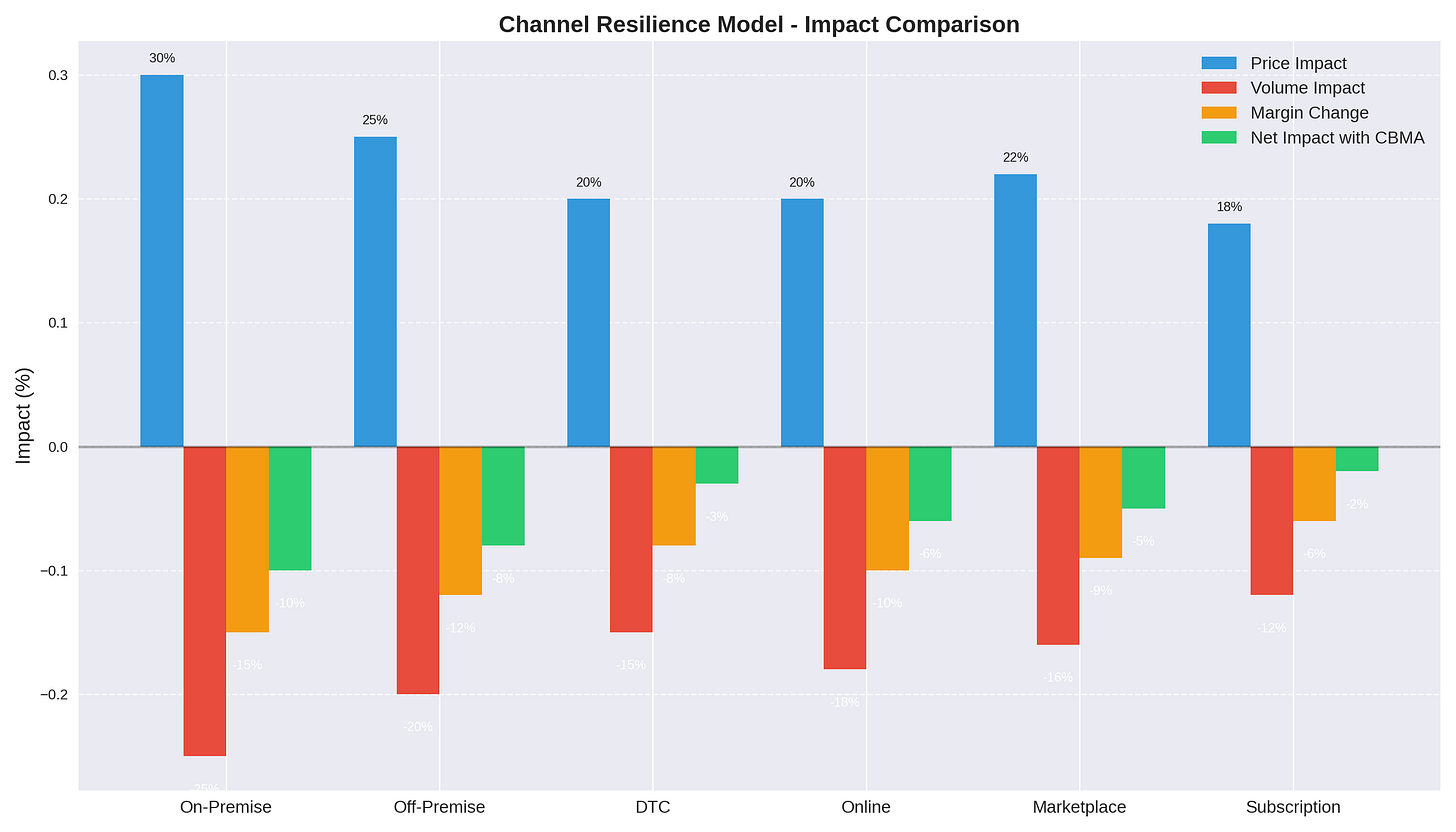

The Channel Revolution: Why Distribution Strategy Trumps Price

Perhaps the most underreported aspect of tariff impact is how dramatically different sales channels respond to the same price shock. Research reveals traditional on-premise locations see the highest price impact (+30%) and volume decline (-25%), while direct-to-consumer channels demonstrate remarkable resilience with only a -8% margin impact.

Even more striking is the performance of subscription models, showing just -6% margin erosion despite price increases. This pattern isn't coincidental—it reflects fundamental differences in how consumer relationships manifest across channels.

Transaction-based purchases (a bottle grabbed from a shelf) are highly price-sensitive. Relationship-based purchases (a subscription from a producer whose story resonates) demonstrate notably greater resilience to price shocks. During previous tariff periods, DTC channels consistently outperformed traditional retail across categories.

Consider Vinovest, a wine investment platform that navigated European wine tariffs by shifting from a transaction model to a subscription approach. When 25% tariffs hit European wines in 2019, they built a "tariff-resistant portfolio" for subscribers, emphasizing storytelling and experiences over pure value. The result? Their subscriber base grew 210% during the tariff period while conventional importers saw double-digit declines.

For spirits brands, this presents a clear directive: channel selection becomes as strategically important as product development in tariff environments. Investing in direct relationships with consumers through clubs, subscriptions, and experiences offers natural insulation against price sensitivity—a truth that transcends the beverage category.

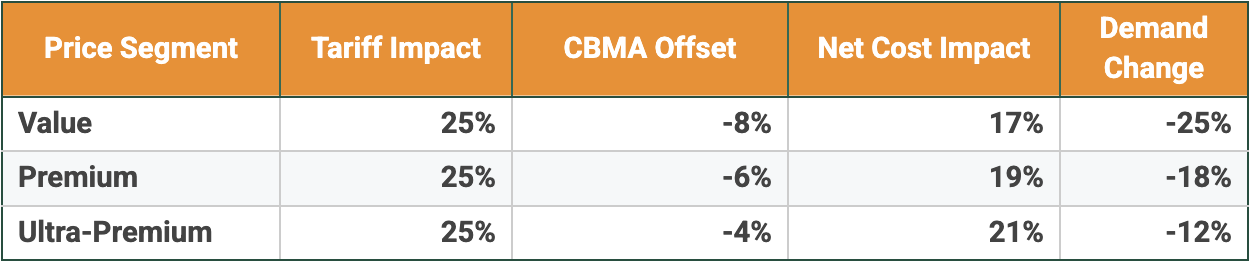

The Regulatory Arbitrage: CBMA and Beyond

Smart brands don't just adapt their market approach—they leverage regulatory frameworks to create competitive advantages. The Craft Beverage Modernization Act (CBMA) presents a perfect case study in regulatory arbitrage during tariff periods.

The CBMA reduces federal excise tax from $13.50 to $2.70 per proof gallon on the first 100,000 proof gallons. Our modeling shows these benefits can offset 4-8% of tariff impacts, creating a substantial buffer for qualified producers. When combined with premium positioning and resilient channels, the effective tariff impact can be reduced to as little as 2-3%—transforming an existential threat into a manageable challenge.

This creates a strategic opportunity: smaller producers focusing on premium products with high margins might actually gain competitive advantage against larger producers in a high-tariff environment.

Channel Resilience Model with CBMA Relief Effects

Sales channel performance during tariff periods reveals remarkable differences in resilience, particularly when combined with CBMA (Craft Beverage Modernization Act) benefits:

CMBA Relief Analysis

Key Insights:

Direct-to-consumer channels demonstrate remarkable resilience with only 8% margin impact vs 15% for traditional on-premise

Subscription models show the best performance with just 6% margin erosion

CBMA benefits provide significant relief—reducing effective cost increases by 4-8% depending on volume

The combination of premium positioning + CBMA benefits + resilient channels can reduce net impact to as little as 2-3%

This model illustrates that channel selection is as important as product positioning during tariff periods. Subscription and DTC models create stickier customer relationships that weather price shocks better than transactional purchases. When layered with CBMA benefits (which provide greater relative relief for smaller producers), alternative channels become a strategic imperative rather than just a nice-to-have.

Beyond CBMA, Foreign Trade Zones (FTZs) offer another regulatory tool. Brands can ship products into U.S. FTZ warehouses without immediately paying tariffs, then gradually release goods into commerce. This improves cash flow and provides flexibility if policies change.

A third strategy involves shipping format transformation. Our supply chain experts project that within 24 months, up to 40% of premium imports will shift to bulk shipping models with U.S. bottling operations—reducing dutiable value while creating domestic jobs.

Casa Noble Tequila pioneered this approach after earlier trade tensions, establishing a bottling operation in California for bulk-imported tequila. The brand still produced in Jalisco, maintaining authenticity and designation of origin, but realized substantial savings by shifting bottling, labeling, and packaging stateside. This hybrid approach reduced effective duties by nearly 30% while creating quality-control jobs in California.

The Future Market: Bifurcation and Opportunity

Based on analysis and historical precedents, I predict several key developments if the 25% tariffs persist:

Accelerated Market Consolidation: Within 12-18 months, 15-20% of small producers will exit the market or be acquired as compliance costs and margin erosion become untenable. Large producers will strategically acquire premium brands at favorable valuations.

Premium Segment Bifurcation: The premium segment will split into two tracks:

"Premium Lite" brands that maintain price points by reducing quality, proof, or bottle size

"True Premium" brands that elevate storytelling and experience to justify higher prices

Channel Transformation: Off-premise retail will lose share to direct channels, with subscription models growing 30-35% year-over-year as consumers seek value and convenience. Traditional three-tier distribution will remain dominant but lose 8-10 percentage points of market share.

Supply Chain Restructuring: Bulk shipping with domestic bottling will become standard practice for premium imports, creating new infrastructure needs and potential job growth in border states.

Policy Evolution: We anticipate tariff exclusions for certain specialty categories within 6-9 months as industry advocacy highlights job impacts and consumer backlash grows.

The ultimate winners will be nimble premium brands that adapt quickly—leveraging CBMA benefits, building direct customer relationships, and optimizing supply chains while maintaining brand integrity. Those who merely try to wait out the tariffs or engage in price competition will likely struggle to recover lost market share even if tariffs are eventually removed.

A Contrary Perspective: Could Tariffs Actually Strengthen the Category?

While most industry voices decry tariffs as universally harmful, a contrarian view deserves consideration: could these trade barriers ultimately strengthen the premium spirits category by accelerating necessary transformations?

Three arguments support this unpopular perspective:

First, tariffs may accelerate the premiumization trend already reshaping the industry. By making value products disproportionately expensive, tariffs push consumers toward either truly premium offerings or domestic alternatives. The "middle ground" of semi-premium imports, often criticized for inconsistent quality and questionable authenticity claims, may be squeezed out—leaving a clearer distinction between authentic premium products and value options.

Second, trade barriers could drive innovation in product development and distribution. The Australian wine industry, devastated by Chinese tariffs, ultimately emerged stronger by developing new markets, embracing digital distribution, and emphasizing sustainability—transformations that might have taken decades without the catalyst of trade disruption.

Finally, domestic bottling operations for imported spirits create unprecedented opportunities for transparency and localization. When a Mexican distillery establishes bottling in Texas, it creates direct relationships with local communities, generates American jobs, and often improves quality control through closer supervision of the finished product.

This perspective doesn't dismiss real hardships that tariffs create, particularly for small producers. However, it recognizes that market disruptions, while painful, often accelerate positive transformations that might otherwise take decades to materialize.

The Path Forward: Strategic Imperatives for Spirits Brands

For brands navigating this complex landscape, five strategic imperatives emerge:

Embrace the premium paradox: Resist the urge to compete on price. Instead, double down on storytelling, authenticity, and experience to justify premium positioning.

Diversify distribution channels: Develop direct-to-consumer capabilities where legally permitted, with particular emphasis on subscription models that create recurring revenue streams.

Optimize for regulatory advantage: Work with specialists to maximize CBMA benefits, explore FTZ strategies, and consider supply chain restructuring to minimize tariff impacts.

Build resilient supply chains: Evaluate bulk shipping and domestic bottling options, particularly if you anticipate sustained trade tensions.

Engage in collective advocacy: Join industry groups pressing for tariff exemptions for specialty products without domestic equivalents.

Platforms like Maguey Exchange (MGx) specialize in helping artisanal producers navigate these complexities. By combining regulatory expertise, supply chain optimization, and market channel support, MGx enables small producers to implement sophisticated strategies previously available only to large corporations.

Conclusion: The Paradoxical Opportunity

While tariffs create undeniable challenges, our analysis reveals that they don't affect all market segments equally. For premium brands with the right strategy, trade barriers can actually accelerate transformation and growth rather than spell doom.

The spirits industry stands at an inflection point. Brands that merely react to tariffs as a temporary disruption to be endured will likely struggle. Those who recognize this moment as a catalyst for strategic repositioning—embracing premium storytelling, channel transformation, and supply chain innovation—may emerge stronger than before.

In this environment, digital platforms that democratize access to supply chain efficiency, regulatory expertise, and direct channels will play an increasingly vital role. The future belongs not to the largest producers but to the most adaptable ones.

What's your perspective? Is your brand viewing tariffs as an existential threat or a transformative opportunity? How are you adapting your channel strategy and supply chain to thrive in this new landscape?

This analysis is based on market data, historical precedents, and industry expertise. While simplified for clarity, it reflects observed patterns across multiple tariff episodes. Individual results may vary based on specific market conditions, product categories, and business models.